ROCKRIX:

Digital Asset Market Evaluation Guided by ROCKRIX Intelligence

Sign up now

Sign up now

ROCKRIX continuously monitors digital asset markets as trading activity develops. Instead of evaluating individual price shifts, the system considers participation intensity, directional consistency, and movement patterns to highlight emerging market structures.

Incoming data is processed through adaptive AI layers to ensure analytical output remains consistent. Temporary fluctuations are filtered out so that attention remains on signals linked to sustained trends and structural alignment.

As directional momentum begins to form, ROCKRIX organizes insights into layered evaluation frameworks. Continuous monitoring supports informed interpretation during transitional phases while noting that cryptocurrency markets are highly volatile and losses may occur.

Rather than waiting for delayed confirmation signals, ROCKRIX evaluates evolving market dynamics as balance begins to shift. Changes in price pressure, liquidity flow, and engagement levels are assessed immediately and organized into an understandable framework. By prioritizing current market behavior over past data, analysis remains focused on present forces, allowing improved clarity during unstable phases. Cryptocurrency markets are highly volatile and losses may occur.

Instead of focusing only on immediate price swings, ROCKRIX interprets instability at the behavioral foundation of the market. Changes in force distribution, imbalance development, and intensity behavior are reviewed to translate disorder into structured insight. Every signal contributes timing awareness and contextual relevance for disciplined market evaluation. Cryptocurrency markets are highly volatile and losses may occur.

During volatile phases, ROCKRIX improves directional alignment by reviewing changes in participation behavior, response intensity, and layered validation processes. Broad market activity is refined into focused insight without reliance on delayed confirmation methods. Analytical output is released only after verification, ensuring relevance to active and genuine market conditions.

ROCKRIX applies purpose built analytical models that adjust across multiple evaluation styles while maintaining structural consistency. Trade execution is not supported, and the platform functions strictly as an intelligence environment. Each framework combines verified data, adaptive analytical layers, and continuous pattern observation to encourage logical assessment and informed interpretation.

ROCKRIX analytical environment where data processing is protected through layered safeguards and managed access. Trade execution is excluded, ensuring assets and sensitive account information are never handled by the system. Continuous oversight reinforces reliability, limits unnecessary data retention, and preserves analytical integrity.

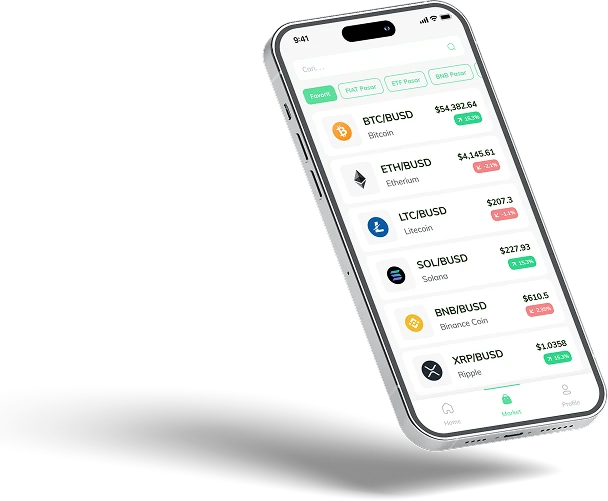

ROCKRIX displays market behavior through an organized visual structure that highlights key price zones, directional movement, and phase development. Visual representation is generated through algorithmic assessment rather than assumption based modeling. This approach supports consistent review, objective comparison, and neutral observation without emotional bias.

ROCKRIX concentrates on current price behavior instead of prioritizing historical cycles. Emerging momentum is identified at its point of development and monitored with precision. Analytical focus remains on present market dynamics rather than delayed influence from prior activity.

Complex market activity is translated into organized intelligence that emphasizes foundational structure rather than surface level price movement. Analytical output remains aligned with live conditions, allowing momentum and participation shifts to be recognized with balance and clarity. Signal refinement reduces latency impact, filters excess noise, and supports steady evaluation for informed decision making. Cryptocurrency markets are highly volatile and losses may occur.

ROCKRIX maintains flexible alignment as market behavior progresses. Changes in strength, liquidity formation, and breakout development are reviewed in real time without reliance on fixed reference points. Analysis remains centered on active conditions and live participation behavior.

Instead of presenting unfiltered indicators, ROCKRIX confirms incoming data through structured momentum validation processes. Advanced filtering removes insignificant movement, allowing genuine directional behavior to remain clearly visible.

As market balance begins to shift, ROCKRIX detects emerging volume behavior, directional definition, and pressure formation without delay. Continuous monitoring ensures interpretation stays accurate, relevant, and practical during transition phases.

ROCKRIX is designed to support efficient interaction through adaptive controls, intuitive navigation, and a streamlined interface. Insight access and configuration remain fluid, supporting uninterrupted analytical focus.

ROCKRIX reviews emerging market pressure through detailed analysis of participation behavior, reaction timing, and directional development. Instead of reducing findings to simplified signals, market structure is visually explained as activity expands, allowing clearer understanding of how alignment forms.

Live market information is organized into layered momentum frameworks designed to retain clarity during sharp or irregular movement. This organization supports steady interpretation and situational awareness as conditions shift rapidly.

To ensure insight consistency, ROCKRIX functions within protected analytical environments supported by continuous supervision. Data handling remains controlled so insights reflect real time behavior while structured evaluation stability is maintained.

ROCKRIX recognizes emerging directional bias by coordinating multiple confirmation processes including pressure evaluation, validation thresholds, structural activity mapping, and adaptive depth analysis. Insight delivery occurs only after established criteria align, reinforcing clarity and limiting analytical ambiguity.

Directional movement is analyzed using an ordered framework that measures velocity shifts, persistence of direction, and recurring activation simultaneously. Once dominant pressure factors synchronize, insignificant fluctuation is filtered out, preserving confirmed structural signals for accurate market assessment.

ROCKRIX recognizes developing condition shifts before movement becomes visually defined. Subtle rhythm adjustments, pressure redistribution, and balance changes are detected early, supporting alignment with live market development rather than delayed signal reaction.

ROCKRIX adjusts analytical responsiveness to match different evaluation horizons. Short term review receives prompt structured feedback, while longer term observation is guided by stable and measured insight suited for extended analysis.

Through organized flow assessment, ROCKRIX clarifies where directional force initiates, where consolidation establishes balance, and where rotational potential may form. Each phase is logically weighted to support preparation, disciplined evaluation, and actionable clarity.

ROCKRIX reviews multiple projected outcome paths simultaneously by aligning expected behavior with predefined analytical structures. Direction stability, response consistency, and pressure concentration are evaluated together to strengthen insight reliability over time. Cryptocurrency markets are highly volatile and losses may occur.

ROCKRIX translates live price engagement into structured analytical zones through spatial interpretation combined with momentum driven evaluation. Instead of filling the visual field with excess detail, the system highlights areas where continuation or reversal potential begins to concentrate, supporting precise assessment.

The visual framework illustrates how directional energy allocation evolves over time. Compression phases, rotational behavior, and signs of structural weakening are reviewed together to assess whether directional conviction is strengthening or fading.

To preserve analytical accuracy, ROCKRIX displays only elements that retain active relevance. Visual output adjusts dynamically to real time rhythm shifts, while internal prioritization logic continuously reassesses importance to support disciplined and consistent analysis.

A structured reading of price action often demands more than single-metric checks. ROCKRIX threads together volatility channels, seasonal drift trackers, and rotational strength indexes to draft colour-coded scenario maps that update as fresh ticks arrive.

Each component carries its own weight score, so traders instantly recognise which factors drive the current backdrop and where pressure may appear next. Range-projection grids sit beside adaptive correlation matrices, revealing whether capital is flowing toward defensive segments or chasing higher beta names.

These dynamic pairings encourage objective sizing and staging rather than emotion-led reactions. Because metrics are expressed in plain, time-stamped language, newcomers gain early confidence while experienced participants enjoy rapid synthesis without repetitive chart-hunting.

Digital asset markets frequently adjust direction as economic variables such as inflation trends, employment indicators, and growth expectations evolve. ROCKRIX incorporates these factors into a unified macro analytical structure that measures relevance and scale before translating them into organized market context.

Advanced AI processing links broader economic momentum with live crypto price behavior to identify early alignment. By comparing historical transition patterns with current structural behavior, ROCKRIX highlights conditions where external forces begin influencing directional movement.

ROCKRIX combines automated analysis with rule based intelligence to monitor real time changes across digital asset markets. Directional consistency, volume interaction, and distributed activity are evaluated together to identify developing instability before it becomes pronounced

Analytical priorities adjust dynamically in response to live market behavior, ensuring insight reflects structural conditions rather than surface level movement. Clear presentation and user centered design support informed interpretation."

Gradual market transition is often preceded by subtle structural deviation. ROCKRIX links early tempo variation with historical response behavior to generate insight that supports structured readiness instead of reactive decision making.

Unexpected acceleration can develop rapidly. ROCKRIX identifies these movements in real time, outlining defined reaction zones and delivering concise scenario context. Each signal reflects initiation scope and near term relevance, with execution remaining independent.

Continuous market mapping allows ROCKRIX to detect early trend construction before broad participation develops. Directional pressure alignment, strength development, and inflection potential are organized to support forward awareness.

Rapid transitions can challenge orientation, yet ROCKRIX preserves clarity through consistent evaluation during fast conditions. Motion analysis and confirmation logic activate selectively to support structured response. Cryptocurrency markets are highly volatile and losses may occur.

ROCKRIX applies intelligent evaluation frameworks and adaptive logic to interpret evolving price behavior, uncover imbalance within transactional flow, and define credible response regions. Continuous assessment of sentiment behavior, volume progression, and momentum alignment provides directional clarity while all execution authority remains fully independent.

The analytical engine adjusts instantly to preserve visibility during accelerated movement or abrupt directional change. In rapidly shifting crypto environments, systematic interpretation supports disciplined decision making and controlled strategic development.

ROCKRIX transforms fast moving market information into organized analytical direction using AI driven visualization, structured evaluation models, and logic based insight systems. The platform remains completely separate from execution pathways, ensuring analysis is delivered without automated trading or account integration.

ROCKRIX introduces functionality through a progressive learning structure designed to reduce complexity. Initial use prioritizes clarity, guided visuals, and intuitive navigation, while advanced capabilities such as scenario analysis and metric refinement become available as familiarity increases.

No. ROCKRIX does not execute trades or manage positions. The system is dedicated to market context interpretation, timing evaluation, and opportunity identification, while all execution decisions remain fully user controlled.

| 🤖 Registration Cost | Free |

| 💰 Fees | No Fees |

| 📋 Registration | Simple, quick |

| 📊 Education Focus | Cryptocurrencies, Forex, Mutual Funds, and Other Investments |

| 🌎 Supported Countries | Most countries Except USA |